Section 263A UNICAP

- Payam Darian, MBA, CPA

- Nov 11, 2019

- 2 min read

Updated: Dec 18, 2019

Let’s talk about Section 263A UNICAP Rules. This is one of the stickiest subjects so I will be thorough. Business owners are required to capitalize certain expenses. Section 263A was a response to retail companies expensing many costs that were in fact integral to the production of their finished product (inventory).

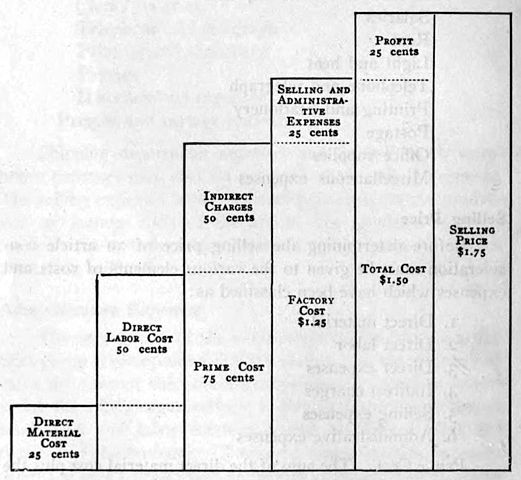

Look at it like this: a widget manufacturer has certain necessary costs to produce any given unit, and as such, the rules require them to classify the necessary costs incurred in preparation of said asset as an increase to the basis of the asset itself (on the Balance Sheet). The inclination is for business owners to Expense (Income Statement) many of these necessary costs in order to decrease their tax liability, which is what necessitated this requirement.

Section 263A applies if one of the following four exceptions does not:

1) For producers, if the costs of property is de minimis (less than 5% of the price charged to customers)

2) For producers, if the production is in long-term contracts under Section 460 that do not involve home production

3) For producers, if total indirect costs are $200,000 or less

4) For resellers, if average gross receipts in a three-year period do not exceed $10 million (personal property only)

In general, smaller manufacturing companies and long-term personal property contractors (construction) are exempt; whereas any real estate business in excess of the $10 million threshold must follow Section 263a.

Large manufacturers are required to capitalize direct costs (labor, production materials, commissions), indirect costs (quality control costs, supervision salaries, depreciation, insurance policies), certain service costs (administrative and general expenses), and property production costs. Note: Service costs are expensed to the extent they are applicable to the current period (i.e. marketing, advertising, selling, distribution).

This means that retail companies that have inventory have a more convoluted calculation to capture on their Balance Sheet, as the Section 263a can be one of the most complicated calculations, alongside the dreaded Alternative Minimum Tax (I fear no calculations, but that’s just me).

Comments